OP Moves

OP Moves

In June 2023, the City of Overland Park held a special mail-in ballot election for the OP Moves sales tax.

Overland Park residents approved a dedicated three-eighth cent sales tax to fund maintenance and improvements to City streets and traffic management systems. The OP Moves sales tax replaced the City’s dedicated one-eighth cent (0.125 percent) sales tax with a three-eighths cent (0.375 percent) dedicated sales tax in April 2024.

Revenue from the tax will be dedicated to improving City infrastructure. This includes primarily streets and traffic management systems, but can include related infrastructure such as curbs, gutters, sidewalks, streetlights, storm sewers and more. These programs were developed in response to Overland Park’s growing infrastructure maintenance, preservation and improvement needs.

OP Moves Sales Tax Overview

A resident committee recommended the City spend an additional $28.5 million per year for infrastructure, funded partially with a three-eighth cent sales tax. The three-eighth cent sales tax will raise more than $24 million to improve and maintain the City’s streets and traffic management systems. The three-eighth cent sales tax took effect in April 2024 and will expire in 2034.

Project Outcomes

Funding from the three-eighths cent sales tax is dedicated to sustaining and improving City infrastructure through repairs, rebuilding, rehabilitating, upgrading, constructing and improving public infrastructure.

Street Improvements

- City streets and related infrastructure

- Local, collector and thoroughfare street, bridge and roundabout infrastructure

- Some projects may include curbs, gutters, sidewalks, streetlights, storm sewers, landscaping and green infrastructure

Traffic Management

- Traffic signals

- Traffic control cabinets and technology

- Traffic signs

- Pavement markings

Priority Projects

The following are project areas the City has identified as high priority for the use of infrastructure funding in the next five years. This is not an exhaustive list of all planned projects, but is meant to illustrate areas that are likely to receive investment or reinvestment with funding from the sales tax. With OP Moves funding, the City expects to improve, rebuild, or perform maintenance on all City streets over the next ten years.

Neighborhood Streets

- Completion of the existing Wycliff project, southwest of 103rd Street and Antioch Road

- Westbrooke South and Moody Hills, east of Switzer Avenue, between 91st and 95th Street

Street Improvements

- Realignment of 82nd Street at Metcalf Avenue

- 77th Street and Metcalf Avenue

- College Boulevard and Metcalf Avenue Mobility Enhancement

- Metcalf from 83rd Street to 87th Street Pedestrian Trail

Bridge Infrastructure

- 109th Street Bridge over Indian Creek

- 103rd Street Bridge over Indian Creek, North Branch

- College Boulevard Bridge over Indian Creek

Traffic Management Systems

- College Boulevard and Lowell Avenue

- College Boulevard and Roe Avenue

- 83rd Street and Nall Avenue

- 91st Street and Antioch Road

- 80th Street and Metcalf Avenue

- 95th Street and Lowell Avenue

Thoroughfares

- 167th Street, Antioch to Metcalf

- Quivira Road, 179th to 187th

- Switzer Road, 167th to 179th

- Mission Road, Bell Drive to 159th

- Pflumm Road, 175th to 183rd

- State Line Road, 175th to 195th

Timeline of Events

March 6, 2023

The City Council approved the holding of the OP Moves mail-in ballot election in June of 2023.

Early June

The Johnson County Election Office sent out mail-in ballots to all registered voters in Overland Park.

June 1, 2023

The City held the first of two in-person town halls to share information on the proposed sales tax with the community.

June 8, 2023

The City held a telephone town hall to share information on the proposed sales tax with the community.

June 13, 2023

The City held the second and final in-person town hall event to share information on the proposed sales tax with the community.

June 22, 2023

Election day – mail-in ballots were due back to the Johnson County Election Office by noon.

The Johnson County Election Office announced preliminary election results.

April 1, 2024

The new three-eighths cent sales tax takes effect.

FAQ

- What was on the ballot?

- How much is three-eighths of a cent?

- Is this a new tax?

- Why a sales tax?

- What does the sales tax cover?

- How do I know funds will be used to improve infrastructure?

- What are the highest-priority projects?

- How much does it cost to build a street?

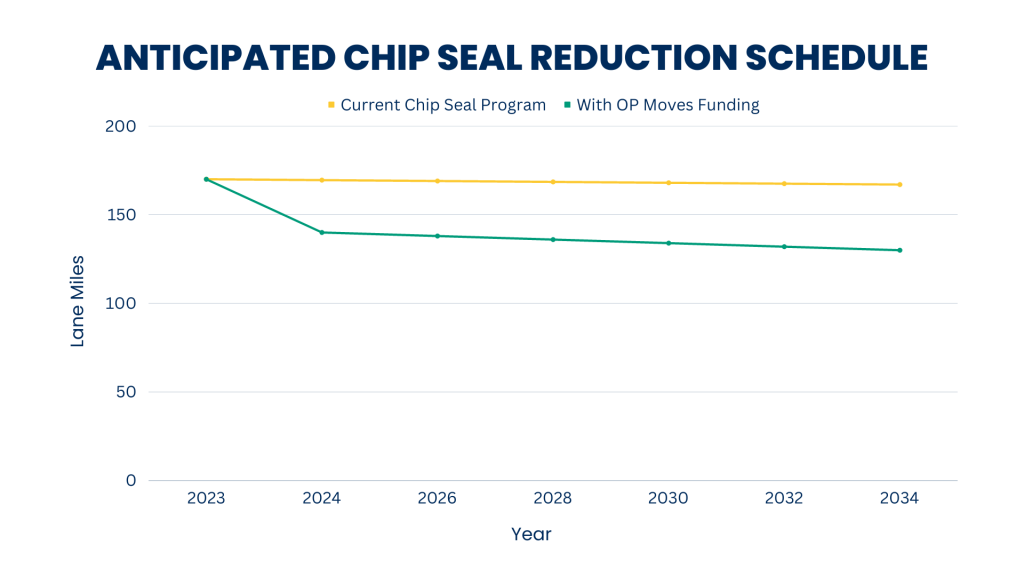

- Will we still have chip seal on our streets?

- Why can’t the City eliminate the use of chip seal with the additional funding?

- How long will the three-eighths cent sales tax be in effect?